Data from Cointelegraph Markets Pro and TradingView followed BTC price action as it made new September highs, topping out at $26,762.

Bitcoin built on strength seen after the previous daily close, ignoring the implications of the U.S. inflation rebound as confirmed by both the Consumer Price Index (CPI) and Producer Price Index (PPI) August prints.

The latter came in at 1.6% year-on-year against market expectations of 1.3%.

Crypto nonetheless joined traditional markets in rejecting the idea that U.S. macro policy might stay more restrictive for longer in order to tame inflation.

According to CME Group’s FedWatch Tool, there was practically no consensus over the Federal Reserve raising interest rates again later in the month. On the contrary, odds of a rate hike pause stood at 97% at the time of writing.

The disconnect between the data and market sentiment was underlined by a decision by the European Central Bank (ECB) to hike rates by 0.25% on the day.

“This is their 10th consecutive rate hike putting rates at 4.5%, their highest since 2001,” financial commentary resource The Kobeissi Letter wrote in part of a reaction on X (formerly Twitter).

Kobeissi added that although the ECB had signalled that the latest hike could be the last in the current cycle, futures markets were still 30% sure of continuation.

“Central banks around the world are bracing for a LONG pause with elevated rates,” it concluded.

Eyeing the state of play on Bitcoin, market participants were hopeful that another leg up would take BTC/USD to $27,000.

Related: Bitcoin price can hit $46K by 2024 halving — Interview with Filbfilb

“Bitcoin still acting out the Power of Three setup -- pushing into the local resistance,” popular trader Jelle told X subscribers in part of the day’s analysis.

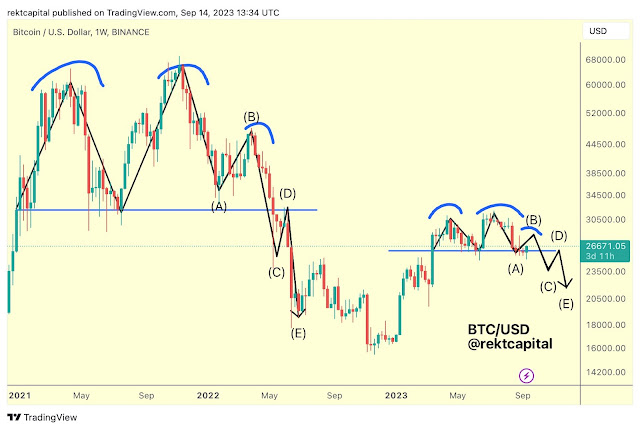

More conservative on the outlook for BTC price strength was trader and analyst Rekt Capital, who eyed an ongoing repeat of a chart fractal from 2021 — Bitcoin’s latest all-time high.

“Bitcoin bounces from ~$26,000. And as long as $26k holds as support, Phase A-B of the fractal could be in play,” he wrote alongside explanatory charts.

.jpg)

0 Comments